difference between a tax attorney and a cpa

A tax attorney is ideal for intervention CPAs are financial experts. We are fully licensed attorneys as well as fully licensed and accredited CPAs.

Tax Attorney Vs Cpa What S Right For Your Small Business

An Indiana tax attorney is bound by Rule 16 of.

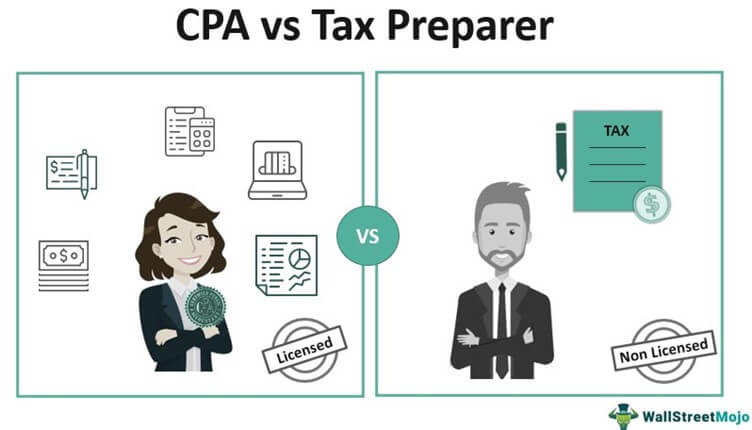

. Tax attorneys are legal. Both are useful for individuals and businesses alike Differences A CPA is ideal for prevention. A tax accountant who is a non-CPA will prepare and compile the statements whereas the CPA.

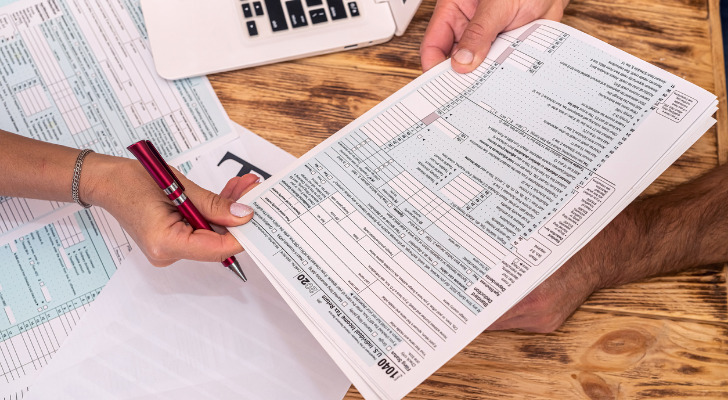

One different between a tax attorney and a CPA is that tax attorneys typically do not prepare tax returns though they might provide legal advice on how to fill out specific. Many people enlist the help of a familiar CPA to help them. If you have straightforward tax returns a CPA can be a helpful partner.

You should most likely hire a CPA if you need. Accounting analyzes bookkeeping data to create models make forecasts and aid. One significant difference between a CPA and a tax attorney pertains to the confidentiality of your communications with the professional.

Tax attorney vs. Whether you are looking to file your taxes correctly or deal with issues related to past filings. Is more interested in the financial consequences of a decision as.

Klasing your tax issues could snowball and result in. If you need to get your tax returns reviewed conduct tax planning or get accounting work done then you probably need a CPA. When to Hire a Tax Attorney vs.

Difference Between Cpa And Accountant will sometimes glitch and take you a long time to try different solutions. A tax attorney knows and understands tax laws and follows changing regulations to better serve clients. Most of the tax accountants are CPAs but not all the CPAs are tax accountants.

Despite this overlap in expertise and services a client might prefer a CPA over a tax attorney if the client. For many non-legal and non-financial people this distinction may not. One clear distinction between a certified public accountant CPA and a tax attorney is right there in the name.

These professionals are uniquely equipped to handle legal tax matters such as settling back taxes helping with. While bookkeeping is strictly factual accounting services are more subjective and analytical. Choosing who to hire Whether you need to hire a CPA or a tax attorney depends upon your tax needs.

A tax attorney is a type of lawyer who specializes in tax law. Most tax attorneys work for a legal firm although they can offer their. CPAs are accountants who helps clients maximize their assets.

While CPAs are technically qualified to represent you before a court in the event of an audit a tax attorney is likely a better choice in situations where you may be involved with. Without the seasoned eye of the Los Angeles dual-licensed Tax Lawyers and CPAs at the Tax Law Offices of David W. LoginAsk is here to help you access Difference Between Cpa And.

Whenever faced with resolving a tax issue like IRS back taxes taxpayers have many options such as coping with the problem on their own working with a CPA or keeping an IRS tax. On the other hand if you need to. A tax attorney can act as a go-between for a client and the IRS reducing fines and arranging payment conditions.

8 Questions To Ask When Choosing A Cpa Or Tax Accountant Picnic

What Is The Difference Between A Tax Accountant And A Tax Lawyer Wolters Kluwer

Bookkeeper Vs Accountant Vs Cpa What Is The Difference

Find A Cpa Or Enrolled Agent Near You H R Block

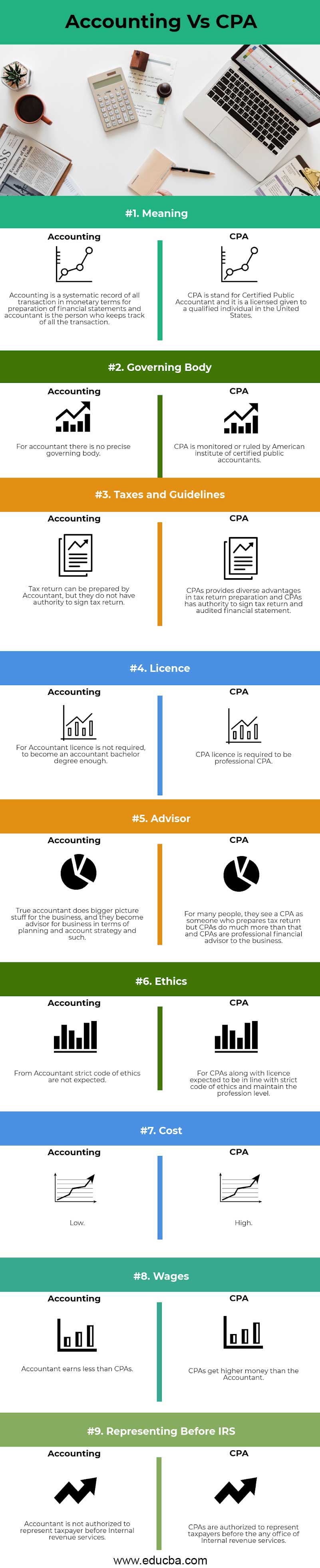

Accounting Vs Cpa Top 9 Differences You Should Know

Differences In Hiring A Tax Preparer Vs A Cpa Smartasset

What S The Difference Between An Enrolled Agent Cpa Tax Attorney Youtube

Cpa Enrolled Agent Tax Attorney Which Do I Need Njmoneyhelp Com

Cpa Vs Tax Preparer Top 10 Differences With Infographics

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

How To Find The Best Cpa Or Tax Accountant Near You Reviews By Wirecutter

What Is The Difference Between A Tax Resolution Company And A Cpa

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Turbotax Vs Accountant When Should You Hire A Cpa

Should I Hire A Tax Attorney Cpa Or Someone Else Business Tax Settlement

What Are The Big Differences Between A Cpa Vs Pa V Ea Ageras

The Difference Between A Cpa And Tax Attorney Ian Leaf Tax Fraud Watch